If you’re hoping to make a big purchase in the future, consider beginning to track your finances today. Follow this article to learn all sorts of financial tips.

Market trends are important in forex trading. Always be informed, this way you know when is the best time to buy low and when to sell high. Don’t sell on upswings or downswings. Be clear in what you want when you are not going all the way through a trend.

You can improve your finances dramatically by taking advantage of available discounts. This is not the time for brand loyalty. Buy items for which you have coupons. For instance, if you regularly purchase a specific brand of detergent, you should start prioritizing other brands if there are coupons available.

In order to improve your finances, never pay full price. Don’t feel like you need to be loyal to specific brands, and concentrate on buying only when you have a coupon handy. As an example, if you usually purchase Tide laundry detergent, but presently have a money-saving coupon for Gain, purchase the Gain and save some money.

Always have a small envelope on your person. Put every business card or receipt you receive into this envelope. This way you can ensure you have all the documents you need for your records. It will be good to have them on hand, so that you can verify all the charges on your credit card statement and contest any that are incorrect.

There are generally 90 day or year long warranties on products, so usually if something is going to go wrong, it will do in within that time period. Extended warranties can end up costing you more money in the long run.

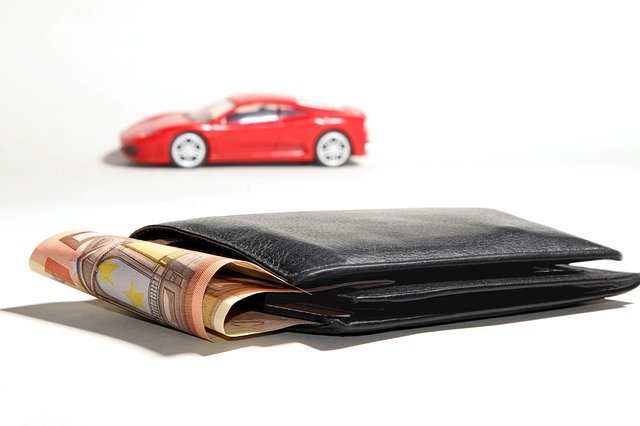

The two biggest purchases you make are likely to be your home and car. Payments on your home and car are almost certain to make up the majority of each month’s budget expenses. You may consider making extra payments to lower the amount of interest that you end up paying.

Your credit score might even go down as you work to increase it. It doesn’t mean that you’ve made a wrong move. Keep paying your bills on time and doing the right things, and your score will rise eventually.

You can automatically have a set amount of money moved to your savings account via your checking account as often as you choose. Set up an automatic account if you find it hard to put some money aside. It is also a great way to save for an important future event, such as a special vacation or a wedding.

A yard sale is a great way to get rid of old items while earning you some extra cash. Some people allow you to sell their items at your garage sale for a fee. A person can be as imaginative as possible when holding a garage sale.

Rather than risking your money, it would be better to put that money into a savings account or invest in something wise. That way, you are certain to grow your money rather than flushing it down the toilet.

Your car and house are very likely going to be your biggest expenses. Payments and interest rates are what will be a huge part of your expense each month. Add more money to the payment every month or make an extra payment once a year to pay it down faster.

If you tend to use lots of money buying Christmas gifts, try making your presents instead. This can save you thousands of dollars throughout the holiday season. Think of creative ways to cut costs, and show your friends and family your artistic side.

Credit Card

When you’re having trouble getting rid of credit card debt, avoid adding new charges. Reduce your expense as much as you can and find another payment method to avoid maxing that card out. Don’t use the card until you have paid off the balance in full.

If you want to apply for a credit card, but are under 21, understand that rules have changed lately. It used to be easy for college-age students to get a credit card. A cosigner or verifiable income is required these days. Always research the requirements and the fine print when considering a credit card.

Family members who have experience in the financial industry are a great resource for learning about personal finances. If one personally does know someone like this, maybe a friend of a friend who knows how to handle their finances could be a help as well.

If collection agencies are after you, your debt will expire after some time if not repaid. Ask someone when a debt can be erased and do not give a collector money for a very old debt.

Even if you’re careful with money, you can run into unexpected financial issues. It is always smart to know the late fees associated with late rent payments, and the absolute final day payments are due before late charges accrue. You will want to know all of the ins and out when you get into a lease.

To keep yourself from splurging and wasting your savings, give yourself a cash allowance. You should feel free to buy whatever you like with your allowance, but exercise self-control and never give yourself more after you’ve reached your limit. It’s a way to let yourself enjoy small treats without doing damage to your budget.

You cannot fix your credit before you get out of debt. Cut back on spending and pay off debts, loans and credit cards. For example, consider dining in your own home, instead of grabbing take-out, or limit the amount you spend on social outings. If you take your lunch to work and do not eat out during the weekend, you can save lots of money. If you are serious about having good credit, you will need to make a commitment to reduce your spending.

Make a super-large wall chart that shows all of your minimums due and due dates. This will allow you to see your payments and let you pay them within the right time frame even if you don’t get the bill via mail. This will help you budget and keep you from incurring late fees.

Do something to save money every day. Rather than shopping the same market all the time and making the same purchases, peruse the local papers to find which stores have the best deals on a given week. Make sure you are willing to purchase on-sale food.

Save on Christmas gifts by making presents instead of spending money. You can save a lot of time and money, not to mention the fact that you will be creating something from your own hands, which can mean more than a store bought gift. You will increase your net worth and reduce your overall cost with creativity.

As previously mentioned, taking control of your finances now can help you save for pricier purchases later. With the tips from this article in hand, you can make better decision regarding your finances.