Have you been out searching for a new home and wondering how you will be able to afford it? There is a lot to know when it comes to home loans. Whatever the reason you found this article, everyone can use these tips to increase their understanding of home mortgages.

Don’t be surprised by what’s on your credit report after you try to secure a home loan. Before you start the process, look over your report. Your credit rating should be clean and free of errors. This can help you qualify for a good loan.

In order to be approved for a home loan, you need a good work history. A lot of lenders need at least 2 steady years of work history in order to approve a mortgage loan. Too many job changes can hurt your chances of being approved. If you’re in the process of getting approved for a home loan, make sure you do quit your job during the process.

Regardless of your financial woes, communicate with your lender. Mortgage brokers will usually negotiate new terms with you, rather than allowing your home to go into foreclosure. Be sure to discuss all your options with your mortgage holder.

Most mortgages require a down payment. You may not need to with some firms, but most lending firms require a down payment. Consider your finances carefully and find out what kind of down payment you will need to provide.

Plan out a budget that has you paying just 30% or less of the income you make on a mortgage loan. If you have too much income headed to your mortgage, financial problems can ensue quickly. Keeping yourself with payments that are manageable will allow you to have a good budget in order.

If you plan to get a mortgage, make sure that you have good credit. Lenders review credit histories carefully to make certain you are a wise risk. Take a look at your report and immediately get to work on cleaning it up if you need to so that you can get a loan.

Think about finding a consultant for going through the lending process. A home loan consultant can help make sure you get a good deal. They will also make sure that all of the terms of your loan are fair.

Talk to several lenders before picking one. Check with the Better Business Bureau, online reviews, and people you know who are familiar with the institution to learn of their reputation. When you know all the details, you can make the best decision.

Try and keep low balances on a few credit accounts rather than large balances on a couple. You want to make sure the balances are less than 50 percent of the credit available to you. If it’s possible, shoot for below 30%.

Think about applying for a balloon mortgage if you think you might not qualify for other loans. Balloon mortgages have shorter terms, so there’s often a refinance of the remaining principal owed when the initial loan term is up. Rates could increase or your finances may not be as good.

Rate mortgages that are adjustable are known as ARM, and these loans don’t expire when the term is up. However, your interest rate will get adjusted to the current rate on the market. This could increase your payments hugely.

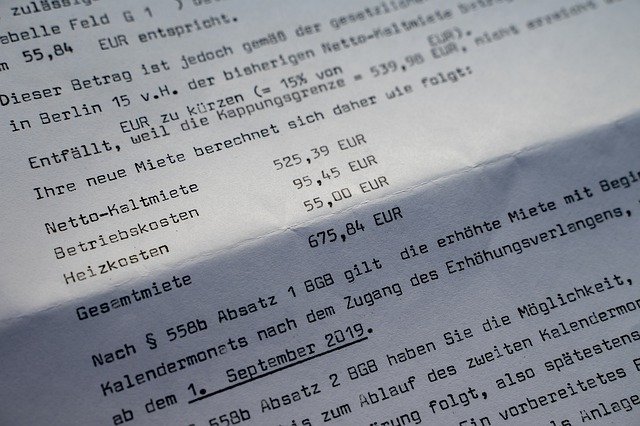

You need to fully understand how much you will be spending on mortgage payments and other fees before entering a mortgage agreement. You will surely have to pay closing costs, commissions and other fees that ought to be itemized for you. It’s possible that you may be able to negotiate these fees with either the lender or the seller.

Be as accurate as possible during the loan process. If you lie about anything, then this might lead to your loan being denied. Why would a lender trust you with a large sum of money when they can’t trust your word?

If you are without cash for a down payment, find out if the seller with think about accepting a second to assist you in getting a mortgage. Many sellers just want to make a quick sale and will help you out. However, now you will need to come up with two payments each month in order to keep your home.

Ask lots of questions when you are getting a home mortgage. Don’t be shy. It is very important that you have an idea about what is going on. Don’t neglect to give your broker your contact information. Make sure that you check your phone messages and email consistently so that you can reply to any requests they have, very quickly.

Fix your credit report to get your things in order. Today’s lenders want to see impeccable credit. They need you to provide some incentive so they can be confident of your ability to repay your loan. So before you apply, make sure your credit is neat and clean.

If you’ve been thinking over what home mortgages mean for you, and wish to use one to your advantage, then you can use the tips here to help you begin. Anyone can obtain their dream home with the mortgage that works for them. Use the above suggestions wisely when you are searching for your dream home.